Our Strategies Help People Overcome and Move On!

Ultimate Marketing 8.0

We're serious about getting the word out about your home!

Using a customer URL allows us to advertise your home on all of

the social sites. Plus the website is mobile-friendly which is

great for those who just surf on their phone.

along with a video tour (if available), community data, school

data, and recently sold homes in the area.

We love to allow the neighbors to get a first look. Postcards are

generally sent to your closest neighbors (25-100 addresses),

inviting them to take a virtual look through the custom URL

leading them to your property website.

A Sign goes up and marketing starts BEFORE the home is active

for Buyers to tour. Often this allows you to complete your

aging finishes, and us to take professional photos and a video.

The Coming Soon timeframe can be anywhere from 7 - 30 days,

and showings are NOT permitted during this period.

CallTodaysHome.com Is easy for Buyers to navigate and save

preferred properties.

Having a clean, easy to read sign is a top priority for us. In

January 2020 we added easy text codes so that Buyers could

easily assess information about your property by being directed

to your custom website.

This one area is where we really shine! Using our professional

photos, we tell the story Buyers want to know. How it feels to

live in your house, what experiences they will have living in the

house, and why purchasing your house is a good decision for

them, just to name a few. Sellers LOVE our brochures and you

will too!

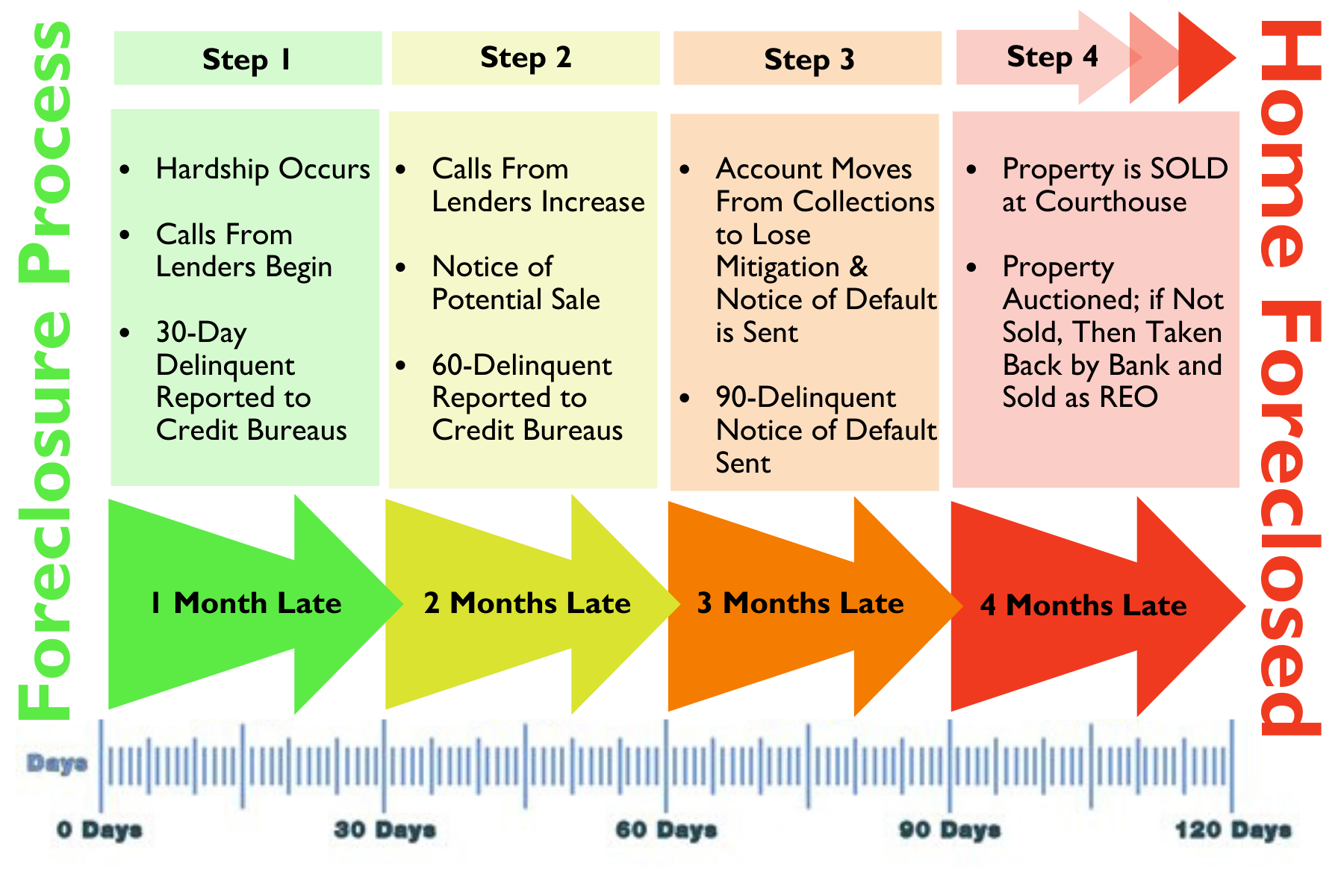

Alabama Foreclosure Quick Facts

- Judicial Foreclosure Available: Yes

- Non-Judicial Foreclosure Available: Yes

- Primary Security Instruments: Deed of Trust, Mortgage

- Timeline: Varies by Process; Typically, 30 - 90 days

- Right of Redemption: 12 months

- Deficiency Judgments Allowed: Yes

In Alabama, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process.

Foreclosure is the official taking over and selling of a property’s deed, which is sometimes the best option that a creditor has, even if it results in a loss on their end.

The Process may include a Short Sale, if the lender allows, however most do not. See the defined terms below.

Short Sale

A short sale, which is the sale of a property for less than what is left on the loan, can be a good option for the lender and borrower when it is not preferable for the borrower to default on their loan. A borrower may opt for this decision because what they owe is more than the value of the property. We have experience in the short sale of Birmingham properties and can help walk you through the process if a short sale is in your best interest as the lender.

Deficiency and Deficiency Judgement

A deficiency is the amount owed on the loan, minus the income generated from the sale of the property. The difference is the Deficiency.

If the foreclosure of a property did not generate enough revenue to cover what the borrower owed to the lender, then the lender may be able to collect the deficiency. They do this by filing a lawsuit against the borrower in Alabama court called a Deficiency Judgment.

Deed in Lieu of Foreclosure

Foreclosure proceedings can be expensive and complex. A deed in lieu of foreclosure can satisfy the borrower’s loan by simply exchanging the deed with the lender without having to go through with a possibly lengthy foreclosure process. This can serve as a good option for both the lender and the borrower in many cases. A deed in lieu of foreclosure can also help protect against a deficiency judgment, according to the Alabama State Bar, which may be an enticement for the borrower.

Renegotiation of a Mortgage or Loan

Quite often the best solution of all, if foreclosure can be avoided, is for the borrower and lender to renegotiate the loan or modify the mortgage. The debtor has a chance to stay on the property and catch up on their payments, while the lender does not lose out by having to accept a lower profit due to foreclosure. Renegotiation of the loan or mortgage can be accomplished via forbearance of principal, switching from an adjustable to a fixed-rate loan, briefly stopping loan payments, decreasing the interest rate or decreasing monthly payments, or extending the life of the mortgage.

Judicial Foreclosure

The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust. However, when no power of sale is present, lenders may, at their option, choose to forego a lawsuit and foreclose by selling the property, as outlined below in the "No Power of Sale Foreclosure Guidelines".

Non-Judicial Foreclosure

The non-judicial process of foreclosure is used when a power of sale clause exists in a mortgage or deed of trust. A "power of sale" clause is the clause in a deed of trust or mortgage, in which the borrower pre-authorizes the sale of property to pay off the balance on a loan in the event of the/their default. In deeds of trust or mortgages where a power of sale exists, the power given to the lender to sell the property may be executed by the lender or their representative. Regulations for this type of foreclosure process are outlined below in the "Power of Sale Foreclosure Guidelines".

Power of Sale Foreclosure Guideline

If the deed of trust or mortgage contains a power of sale clause and specifies the time, place, and terms of sale, then the specified procedure must be followed. However, if the deed of trust or mortgage contains a power of sale clause, but does not specify the time, place and terms of sale, then a foreclosure sale may take place at the front or main door of the courthouse of the county where the property located, after default of the deed of trust or mortgage, for cash to the highest bidder. The sale may not take place until thirty (30) days after the last notice of sale is published.

Said notice of sale must be given by publication once a week for four (4) successive weeks in a newspaper published in the county or counties in which the property is located. If the property is under mortgage in more than one county, the publication is to be made in all counties where it is located. The notice of sale must give the time, place, and terms of said sale, together with a description of the property. If no newspaper is published in the county where the lands are located, the notice shall be placed in a newspaper published in an adjoining county for four (4) successive weeks.

No Power of Sale Foreclosure Guidelines

If no power of sale is contained in a mortgage or deed of trust, the lender, or any assignee thereof, may, after default of the mortgage or deed of trust, either file a lawsuit to foreclose or foreclose by selling the property to the highest bidder for cash at the courthouse door of the county where the property is situated. Said sale may not take place until after notice of the time, place, terms and purpose of the sale has been published for four (4) consecutive weeks in a newspaper published in the county wherein said lands or a portion thereof are situated.

Submit Your Information Now

Denise. S.

Where do I begin?! There aren't enough words to sing my praises for Deb Long! My husband and I didn't know what to expect having never sold a home, and Deb walked us right through every step with patience and kindness. She makes you feel like you are her only client! She was there for us for everything and went above and beyond in all areas. She helped us stage our home, marketed it like crazy on tons of websites including an amazing video, and sold our home in two weeks!! She has remained a friend since we sold our home over 2 years ago! We are so thankful for Deb and recommend her to anyone selling or buying a home.