PROPERTY TAX EXPLAINED

(Homestead Exemption)

All real property, real estate (except that which is exempt by the Constitution and Laws of Alabama) – is subject to ad valorem taxation and must be listed with the County Tax Commissioner.

The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. A homestead exemption is defined as a [tax discount] allotted to a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres.

To claim your Homestead Exemption you must file a Property Classification Assessment with the Tax

Commissioner on or before December 31. This is a requirement for any property you have purchased or

acquired during the previous fiscal year. The fiscal tax year in Alabama runs from October 1 to September 30.

When you file your Property Classification Assessment, you must show proof of interest in the property, such as a deed or other documentation of ownership before being allowed to assign it a Property Classification Assessment.

In the State of Alabama property tax is based on three factors: Assessment Rate, Millage Rate, and Exemptions

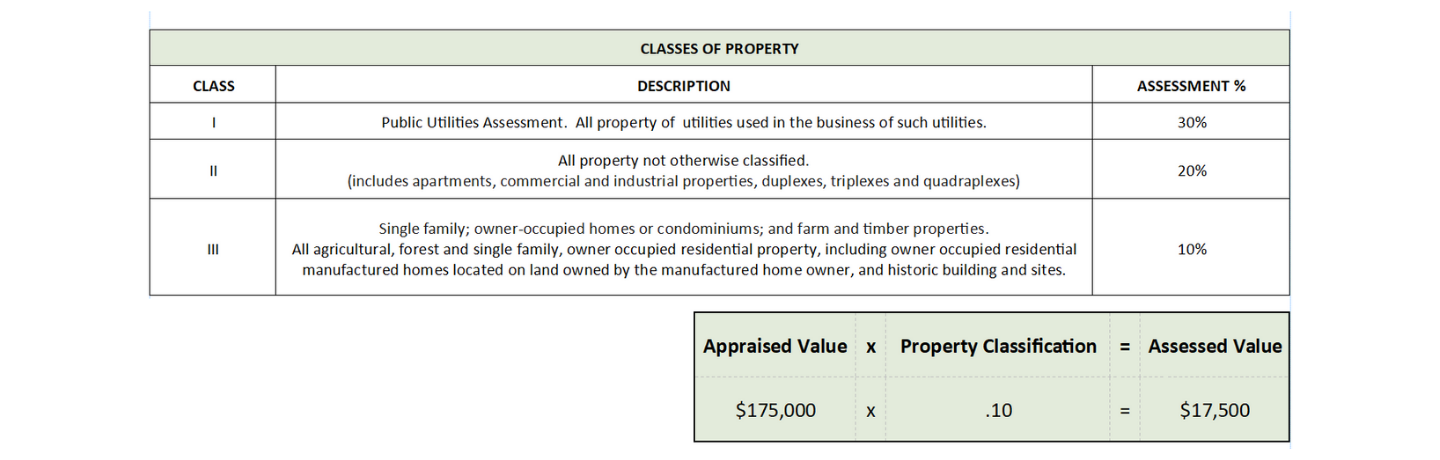

PROPERTY CLASSIFICATION ASSESSMENT RATE—When you purchase or acquire property in Alabama, you file your assessment with the Tax Commissioner on or before December 31 for any property acquired during the previous fiscal year.

Your taxes are calculated using your property’s Assessed Value. This is the fractional amount of market value and is determined by multiplying the Appraised Value (or sales price) by the corresponding Property

Classification, also known as the Assessment Rate. See Chart below.

TAXATION “MILLAGE” RATE

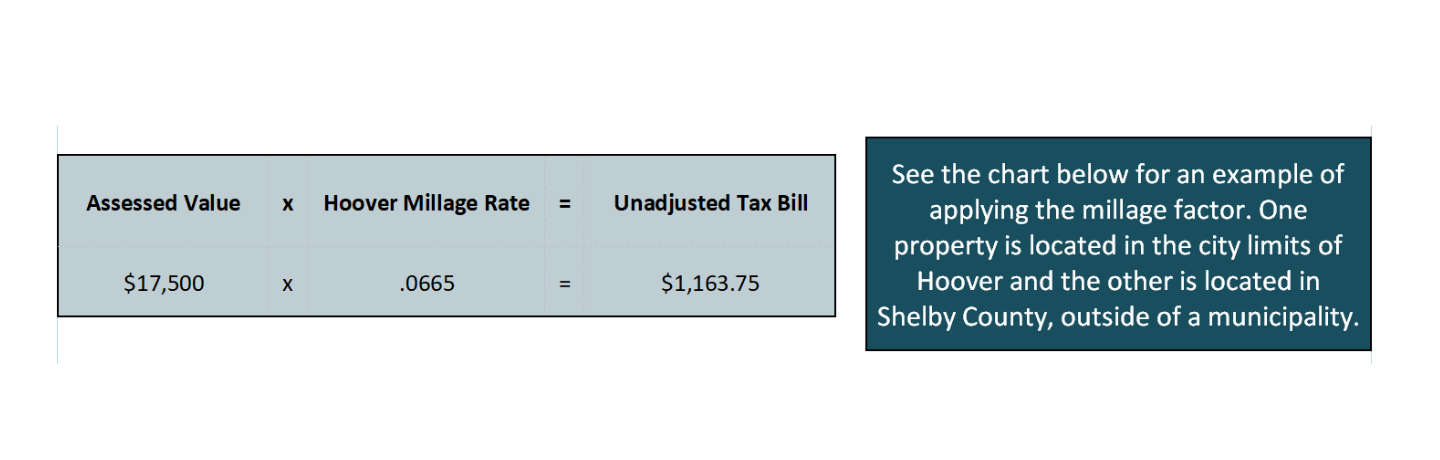

Once the Assessed Value of your property has been determined, you then multiply your Assess Value by the

taxation rate for your area. Taxation rates are computed in “mills” (tenth part of a cent) and are oftentimes quoted in dollars per hundreds or thousands. Millage is the tax rate expressed in decimal form. Millage rates are determined by municipalities, counties, and other taxing agencies. In central Alabama, each millage rate will consist of four parts: State, County, School, and Municipality. You can find your millage rate online or by contacting the Tax Accessors Office. A mill is one-tenth of one cent. (.001) 1 Mill = $0.001

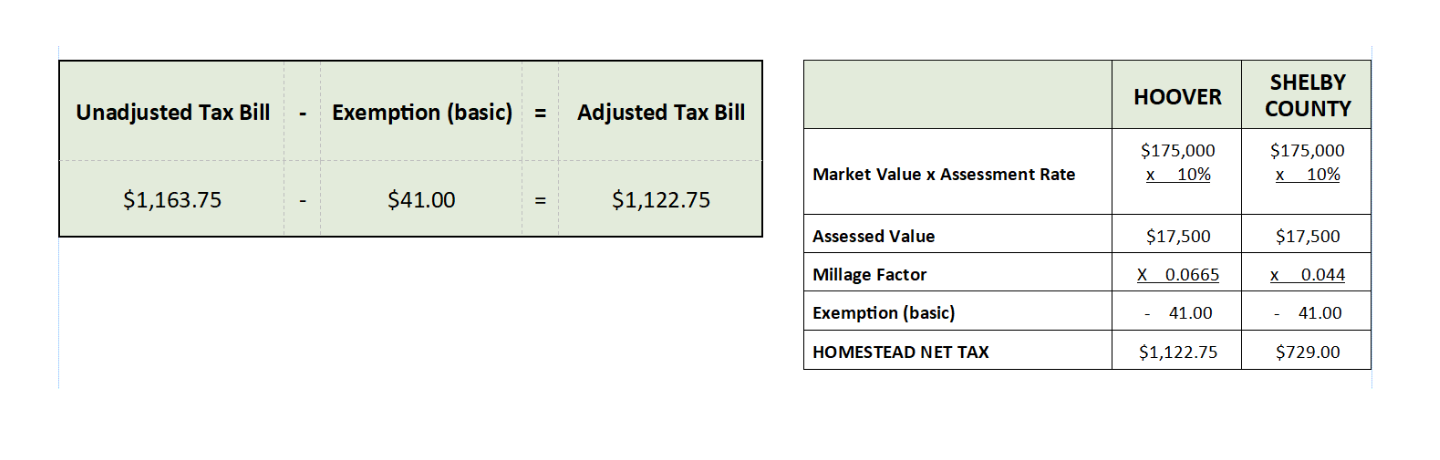

HOMESTEAD EXEMPTION—is allowed to the owner-occupant and is claimed at the time of assessment.

If you are entitled to a tax credit for homestead exemption, it is deducted from your gross tax as shown in the

example below. After determining your unadjusted Tax Bill, subtract any Exemptions you may be eligible for. This gives you the Adjusted Tax Bill.

There are four different types of exemptions a homeowner can claim in the State of Alabama.

A. Any owner-occupant under 65 years of age is allowed a homestead exemption on state taxes not to

exceed $4,000 and on county taxes not to exceed $2,000 assessed value, both excluding all school

and municipal taxes.

B. Homestead “Special” – If you are 65 years of age or older and have a joint net income of $12,000

or less, you are exempt from taxes on the primary residence. You MUST claim this exemption

showing proof of age and income. Once the proof is shown, you will receive a tax credit for all of the

State tax. The County tax credit is based on the first $5,000 of assessed value.

C. Any owner-occupant over 65 years of age, having a net annual taxable income of $7,500 or less, is

exempt from taxes on the principal residence. You must claim this exemption; proof of age and

income is required.

D. Any owner-occupant who is 100% disabled or blind is exempt from taxes on the principal

residence. You must claim this exemption and proof of disability is required. Special exemptions

(A, B, C, and D above) must be filed annually with the Property Tax Commissioner.

If you have questions about the information provided, please contact one of our agents for further explanation, 205.588.8282.

Click the button on the left to start editing!